Editor’s note: Glenn Solomon is a Partner with GGV Capital. Some of his recent investments include Pandora, Successfactors, Isilon, Domo, Square, Zendesk, Quinstreet and Nimble Storage. His personal blog, goinglongblog.com, focuses on growth-stage entrepreneurs who are thinking big. Follow him on Twitter @glennsolomon.

As excitement grows for the upcoming Twitter IPO, the federal government shutdown and pending debt-ceiling issue looms large. There are some in Silicon Valley who believe that the current innovation cycle, powerfully led by mobile and cloud computing, will overwhelm any public market dislocation caused by Washington D.C. ineptitude.

After all, Twitter and other high fliers, such as the rumored 2014 IPO class — including Dropbox, Palantir, Airbnb and Box — are growing fast, operating in huge markets with big and slow-moving incumbents and beginning to show business models that will generate meaningful profit. This has been the recipe of success for LinkedIn, Splunk, Workday, ServiceNow and even Facebook, where IPO investors have done extremely well.

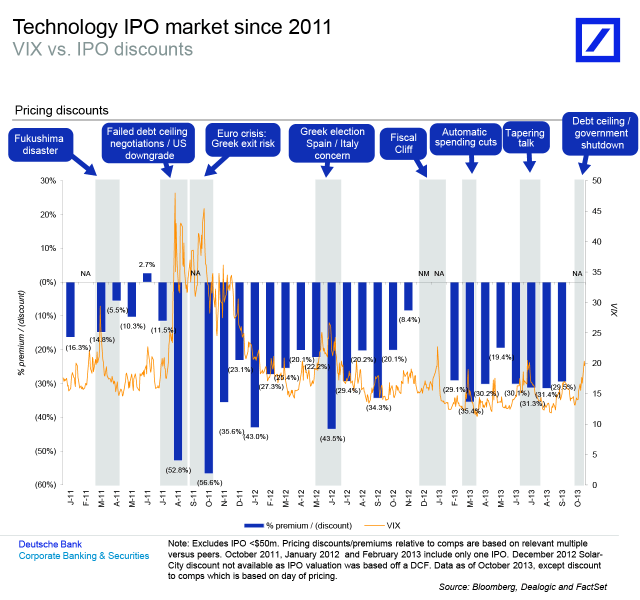

Recent history suggests, however, that in times of macroeconomic disruption, even the strongest of companies can see their IPO price get hit hard. One good way to assess the severity of a market dislocation caused by external events is the VIX, a measure of the implied volatility of the S&P 500.

The chart below from the folks at Deutsche Bank plots the VIX relative to IPO pricing over the past three years. As you can see, during periods when the VIX spikes due to external events, the implied IPO pricing discount increases sharply. For example, during the late summer/early fall 2011 period when U.S. debt was downgraded after the failed debt-ceiling negotiations followed quickly by the Greece-led Euro crisis, the VIX spiked and IPO pricing discounts went from an average of approximately 20 percent down to over 50 percent. Similarly, when the fiscal cliff led to the automatic federal spending cuts in early 2013, the VIX sharply increased, sending ensuing IPO discounts up to over 30 percent, from a range of 10-20 percent in the months prior.

Should the mess in Washington go unresolved over the coming several weeks, a clear risk for Twitter is that the VIX spikes up. If this happens, recent history suggests that Twitter will be forced to price its IPO well below levels it could otherwise achieve.

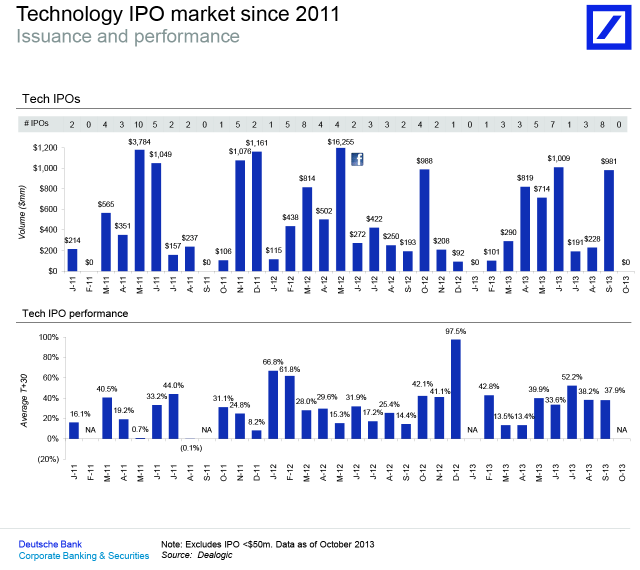

While this situation, if it transpires, will cause Twitter to either raise less capital or suffer more dilution than it would have otherwise, all is not lost. Aftermarket performance of the IPOs that have priced in the last three years doesn’t appear to be highly correlated to IPO pricing.

In fact, as you can see from the chart below, some IPOs that price at steep discounts perform quite well in the ensuing 30 day period. For example, IPOs that priced in mid 2012, during the height of the macro concerns in Europe, were done at steep discounts, yet these IPOs were up 15-32 percent on average in the ensuing 30 days. More recently, IPOs priced at a steep discount during the “taper talk” of this past summer, but this class also performed very well in the ensuing 30 days. So, while Twitter may face IPO headwinds if Washington doesn’t come to its senses soon, a buying opportunity may follow.

Whatever happens, Twitter’s long-term stock price trajectory will have everything to do with its operating performance and the market around it, and very little to do with how its IPO fares.

Created in 2006, Twitter is a global real-time communications platform with 400 million monthly visitors to twitter.com, more than 200 million monthly active users around the world. We see a billion tweets every 2.5 days on every conceivable topic. World leaders, major athletes, star performers, news organizations and entertainment outlets are among the millions of active Twitter accounts through which users can truly get the pulse of the planet.

→ Learn more

Similar Articles: jimmy kimmel labor day K Michelle

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.